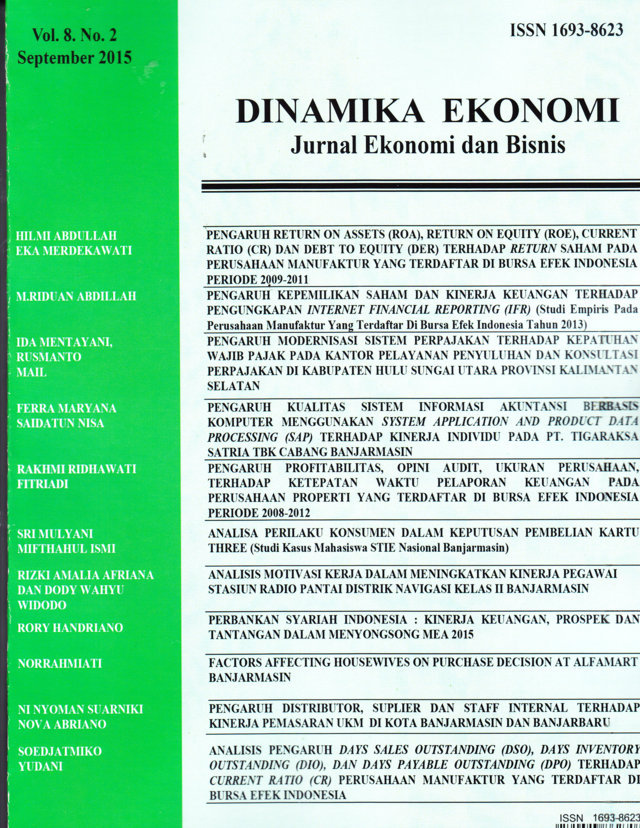

PENGARUH RETURN ON ASSETS (ROA), RETURN ON EQUITY (ROE), CURRENT RATIO (CR) DAN DEBT TO EQUITY (DER) TERHADAP RETURN SAHAM PADA PERUSAHAAN MANUFAKTUR YANG TERDAFTAR DI BURSA EFEK INDONESIA PERIODE 2009-2011

Main Article Content

Abstract

Abstract,

This research was conducted to examine the effect of variable Retun On Assets (ROA), Return on Equity (ROE), the Current Ratio (CR), and Debt to Equity Ratio (DER) on stock returns on companies listed in Indonesia Stock Exchange period 2009- 2011.

The research population is 25 and the sample 19 companies. Data were obtained from the Indonesian Capital Market Directory (ICMD 2013) and analysis techniques used are multiple regression.

The results obtained simultaneously adjusted R2 value of 0.027 means that 2.7% variation of stock returns can be explained by four independent variables are ROA, ROE, CR and DER, while the remaining 97.3% is explained by other variables not included in this research. The results showed no partial any of the variables that affect stock returns.

Article Details

This work is licensed under a Creative Commons Attribution 4.0 International License

References

Bachri, Syamsul, 1997. Profitabilitas Dan Nilai Pasar Terhadap Perubahan Harga Saham Pada Perusahaan Go Public Di BEJ. Jurnal Persepsi edisi khusus Vol. 1.

Ghozali, Imam, 2006. Aplikasi Analisis Multivariate Dengan SPSS. Semarang: Universitas Diponegoro.

Hardiningsih, Suryanto dan Chariri, 2002. Pengaruh Fundamental dan Risiko Ekonomi Terhadap Return Saham pada Perusahaaan Di Bursa Efek Jakarta. Studi Kasus Basic ndustry & Chemica, Jurnal Strategi Bisnis, Vol. 8, Desember.

Liestyowati, 2002. Faktor yang Mempengaruhi Keuntungan Saham di Bursa Efek Jakarta : Analisis Periode Sebelum dan Selama Krisis. Jurnal Manajemen Indonesia, Vol. 1, No. 2.

Natarsyah, Syahib, 2000. Analisis Pengaruh Beberapa Faktor Fundamental Perusahaan Terhadap Harga Saham (Kasus Industri Barang Konsumsi). Jurnal Ekonomi dan Bisnis Indonesia, Vol.5, No. 3, Hal. 294-312.

Ratnasari, Elza, 2003. Analisis Pengaruh Faktor Fundamental, Volume Perdagangan, dan Nilai Kapitalisasi Pasar Tehadap Return Saham Di Bursa Efek Jakarta (Studi Kasus Saham Perusahaan Manufaktur). Tesis Magister Manajemen. Semarang: Undip.

Sartono, Agus, 2001. Manajemen Keuangan Internasional. Edisi Pertama. Yogyakarta: BPFE.

Sulistyo, Aloysius, 2004. Analisis Pengaruh Faktor Fundamental Perusahaan terhadap Return Saham di Busa Efek Jakarta. Tesis Magister Manajemen.

Suwandi, 2003. Pengaruh Beberapa Faktor Fundamental Perusahaan Terhadap Return Saham (Studi Kasus Pada Saham-saham lQ-45). Tesis Magister Manajemen. Semarang: Undip.

www.idx.co.id, diakses 23 Agustus 2013

www.id.wikipedia.com, diakses 3 September 2013

www.duniainvestasi.com, diakses 2 Oktober 2013